FAQ

Anyone who pass through e-KYC

In the event of a loan default, PeerHive will initiate a controlled liquidation process to recover the value of the collateral pledged by the SME during the loan application.

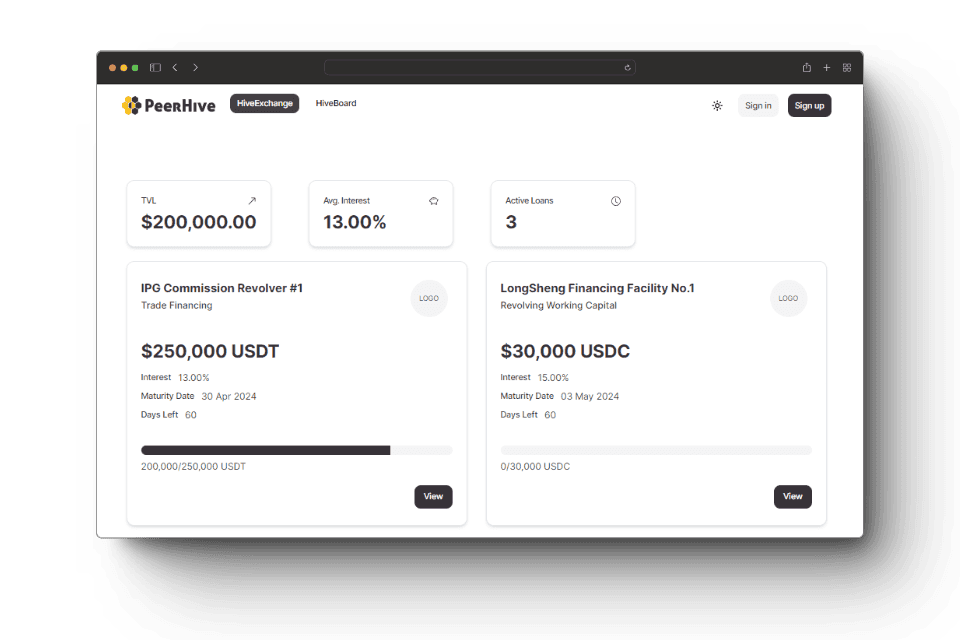

Starting Your Journey to Invest in Global Real World Assets (RWA) through PeerHive

Join a secure, transparent, and asset-backed lending platform empowering businesses and generating returns for investors.

Acquire access to dependable and sustainable returns derived from the cash flows of tangible, real-world assets.

Mitigate risk with loans backed by tangible assets owned by SMEs.

Explore an alternative asset class and diversify your investment portfolio.

Easy way to create a web 3 wallet and start invest using our partner platform.

Investors earn real-world yield through collateralized investment opportunities provided by PeerHive.

At PeerHive, we understand the importance of providing investors with access to high-quality loan opportunities. That's why we have implemented a rigorous vetting process for all SMEs seeking funding on our platform. This multi-step process ensures we select creditworthy businesses with strong growth potential, minimizing risk for you, the investor.

Background Checks: We conduct thorough background checks on the SME's ownership and management team, verifying their experience and qualifications.

Detailed Business Plans: We thoroughly review each SME's business plan, assessing their financial projections, market analysis, and overall business strategy..

Performance Tracking: We closely monitor the performance of funded SMEs, tracking their loan repayments and overall business progres

Anyone who pass through e-KYC

In the event of a loan default, PeerHive will initiate a controlled liquidation process to recover the value of the collateral pledged by the SME during the loan application.

Investing in a Peer-to-Peer lending protocol carries inherent risks. By providing funds to companies seeking loans, you expose yourself to the possibility of loan defaults, potentially resulting in partial or complete loss of your investment. It is advisable to conduct thorough research before making any investment decisions. Do your own research.